Weekly US Dollar Fundamental Forecast

As a rule, markets tend to gravitate towards data that aligns with their expectations. In this context, investors disregarded the acceleration of consumer prices to 2.9% y/y in December and the downward revision of retail sales data for November from 0.7% to 0.8% m/m. Instead, they focused on core inflation and the December retail sales indicator, which failed to align with forecasts. These figures hinder EURUSD bears from resuming the downtrend. In addition, Fed officials have suggested a rate cut in the near future.

US Retail Sales Change

According to FOMC member Christopher Waller, the latest inflation report was particularly favorable, and if prices continue to slow down, the Fed will resume the monetary easing cycle in the first half of this year, with a possible start in March. Such comments are a clear blow to market expectations. The derivatives market forecasts two acts of monetary expansion — in June and December. At the same time, the odds of this happening in March have risen from 29% to 32%. This shift led to a decline in US Treasury yields and a weakening of the US dollar.

The euro received support from news that China has achieved its 5% GDP growth target for 2024, as well as the survival of the government of François Bayrou in France through a no-confidence vote. The acceleration of China’s economy, attributed to substantial fiscal and monetary stimulus, has reached 5.4% y/y in the fourth quarter.

However, investors have expressed skepticism regarding the accuracy of these figures, believing they may have been artificially adjusted to meet certain objectives. Scott Bessent has expressed concerns about China’s economic outlook, suggesting it may be experiencing a recession or potentially even a depression. He attributes this to an economy with an imbalanced focus on military spending and the export sector, which has been a key factor in maintaining GDP growth.

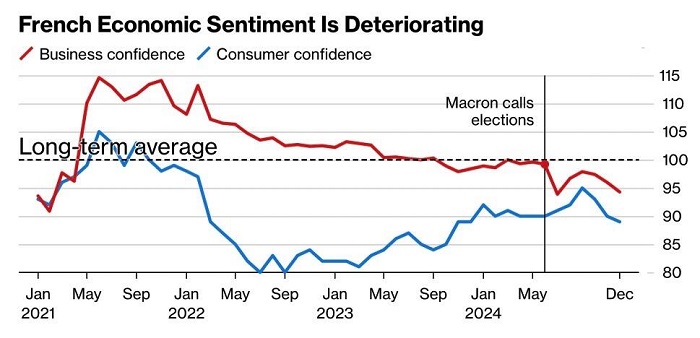

The government of François Bayrou, in contrast to his predecessor Michel Barnier, has shown resilience in surviving a vote of no confidence, receiving support from Marine Le Pen. However, the situation remains tense, and another election could take place in the country as early as summer. The yield spread between French and German bonds risks widening from 80 bps to 100 bps. The difficult political situation cannot but affect economic indicators, which are deteriorating.

French Economic Indicators

The market may have overestimated the likelihood of a prolonged Fed pause, but the euro’s numerous vulnerabilities suggest that a comprehensive correction for the EURUSD pair is unlikely. In addition, the consolidation period preceding Donald Trump’s inauguration appears to be well-founded, as investors prefer to avoid taking significant risks in the uncertainty surrounding the initial steps of the new US administration.

Weekly EURUSD Trading Plan

Against this backdrop, it is better to refrain from entering the market or open short-term long trades on the EURUSD if the pair settles above 1.03, followed by a subsequent reversal, prompting traders to open medium-term short trades.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Myanfx-edu does not provide tax, investment or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.