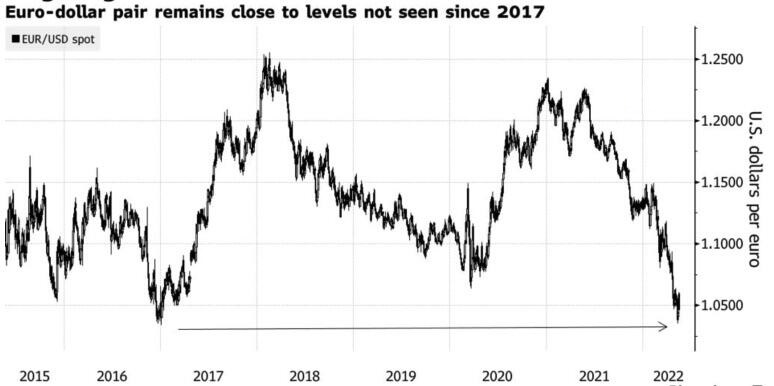

The EURUSD downtrend looks strong, but a correction should start sooner or later. Euro is supported by an improvement of the epidemiological situation in China, the ECB’s verbal interventions, and talks about a Fed rate cut in 2023. Let us discuss the Forex outlook and make up a trading plan.

Weekly euro fundamental forecast

With rare exceptions, people remember the recent past better than what happened many years ago. Today, all talks about a recession in the US end with a discussion of how the Fed will respond to it. Investors remember the events of 2020, so they expect a federal funds rate cut in 2023 following a series of hikes in 2022. One of the reasons for the EURUSD correction up is the expectation that the Fed will ease monetary policy as the recession is approaching.

The euro’s rally against the US dollar is facilitated by the verbal interventions of ECB officials and the fall in the number of COVID-19 cases in China to the lowest level in two months. Furthermore, St. Louis Federal Reserve Bank President James Bullard says the US Fed could cut rates in 2023 and 2024 once inflation is under control. However, Bullard says the central bank should front-load an aggressive series of interest-rate hikes to push rates to 3.5% in 2022.

The EURUSD bulls are supported by the ECB’s officials. Francois Villeroy de Galhau says a weaker euro would go against the price stability objective. Isabel Schnabel adds that they are closely monitoring the impact of the weaker euro-dollar exchange rate on inflation. Naturally, the ECB policymakers are worried about the euro’s weakness. A 5% drop in a euro trade-weighted index could add as much as 0.5 percentage points to inflation, according to JPMorgan.

However, according to Credit Agricole, talk is cheap most of the time. Any verbal intervention to strengthen the euro will work only if it comes hand in hand with concrete policy actions to prop up the currency. In past years, the ECB has argued that it has the tools to prevent the euro from further strengthening, but these speeches have had only a short-term effect.

The EURUSD correction discouraged the investors from the idea of parity. The expectations of parity were based on the war in Ukraine and the related energy crisis, as well as the outbreak of COVID-19 in China. But the situation has changed recently. The FOMC officials are talking about a rate cut in 2023, news from Eastern Europe draws less attention, and the pandemic restrictions in China are being lifted.

I believe investors’ mistake is assuming that a recession will make the Fed lower the rates. Inflation is likely to remain high. So, the monetary tightening cycle could continue next year. Once investors understand it, Treasury yields will resume growing as well as the US dollar.

Weekly EURUSD trading plan

The EURUSD is likely to be corrected up as the old greenback’s benefits do not work, and the ECB is worried by the euro’s weakness. It is still relevant to enter medium-term short trades on the price rise. One could enter a short-term long if the price consolidates above 1.06.

Go to Register with LiteForex Platform

Financial Trading is not suitable for all investors & involved Risky. If you through with this link and trade we may earn some commission.